In the digital age, knowing how to create demat account online has become a seamless and convenient process, allowing investors to effortlessly enter the world of financial markets. A Demat account serves as a gateway to the electronic holding and trading of securities, eliminating the need for physical share certificates. Here’s a comprehensive guide on how to open your investment gateway by creating a Demat account online.

- Choose a Reputable Online Brokerage

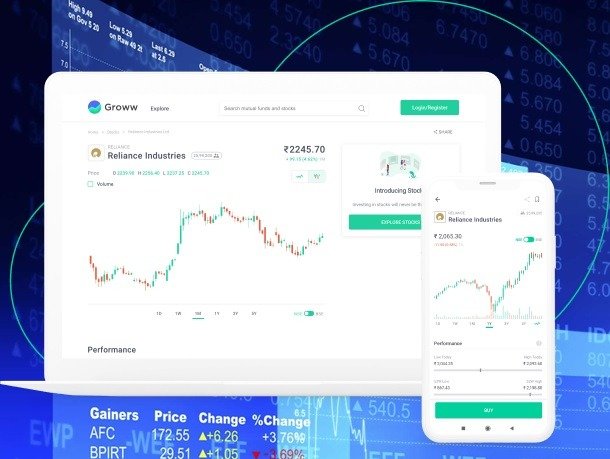

Selecting a reliable online brokerage is the first step towards opening a Demat account online. Research different platforms based on factors such as user reviews, fees and charges, customer support, and the range of services like knowing about HDFC Bank share prices offered. Reputable online brokers often provide user-friendly interfaces and robust security features for a seamless experience.

- Visit the Broker’s Website

Once you’ve chosen a suitable online brokerage, visit their official website. Most brokerages have a dedicated section on how to create demat account, making it easy for prospective investors to initiate the process.

- Click on ‘Open an Account’ or ‘Get Started’

Look for a prominent button or link on the website that says ‘Open an Account’ or ‘Get Started.’ Clicking on this will redirect you to the account opening section.

- Fill in Personal Details

Complete the online application form with your personal details. This typically includes your full name, date of birth, contact information, PAN (Permanent Account Number), and Aadhar number. Ensure the accuracy of the information provided, as it will be used for verification purposes and even for checking HDFC Bank Share price.

- Upload KYC Documents

To comply with regulatory requirements, you will need to upload scanned copies or clear images of your KYC documents. These typically include your PAN card, Aadhar card, passport-size photographs, and proof of address (utility bills, bank statements, etc.). Online platforms often have user-friendly interfaces for document uploads about how to create demat account.

- Choose Account Type

Select the type of Demat account you wish to open. Options may include individual, joint, corporate, or partnership accounts. Choose the one that aligns with your investment goals and requirements while considering to know more about HDFC bank share price.

- E-Signature and Verification

Many online brokerage platforms now offer e-signature options, making the verification process quick and straightforward. Follow the instructions to e-sign the required documents. Some brokerages may also conduct a video verification process for added security.

- Review and Submit

Carefully review all the information you’ve provided before submitting your application. Check for accuracy and completeness to avoid any delays in process on how to create demat account

- Fund Your Account

Once your Demat account application is approved, you’ll need to fund your account to start trading. Online brokerages provide multiple options for funding, such as online transfers, NEFT, RTGS, or payment gateways. Follow the instructions provided by the platform to complete the funding process after checking on HDFC Bank share price.

- Start Trading

With a funded Demat account, you are now ready to embark on your investment journey. Log in to your trading account, explore the available features, and start buying and selling securities based on your investment strategy.